Welcome to Invest Pulse Financial Services, where we believe in empowering investors with knowledge and guiding them through the complex world of finance. One crucial aspect of investing in mutual funds in India is understanding the taxation implications associated with it. In this guide, we will walk you through the tax implications of investing in mutual funds in India, helping you make informed investment decisions.

Types of Mutual Funds

Before diving into taxation, let’s briefly touch upon the types of mutual funds available in India:

1. Equity Mutual Funds:

Equity Holding more than 65%

These funds primarily invest in equity shares of companies. They are known for potentially higher returns but are subject to market volatility.

2. Debt Mutual Funds:

Equity holding less than 35%

Debt funds invest in fixed-income instruments like government and corporate bonds, offering regular income with relatively lower risk.

3. Hybrid Mutual Funds:

Equity Holding between 35-65%

Hybrid funds invest in a mix of equities and debt, providing a balanced approach to risk and returns.

Taxation of Mutual Funds

The taxation of mutual funds in India depends on various factors, including the type of mutual fund, the holding period, and the investor’s tax bracket. Let’s break down the tax implications for different scenarios:

1. Taxation of Equity Mutual Funds:

– Short-Term Capital Gains (STCG):

If you sell your equity mutual fund units within one year of purchase, the gains are considered short-term capital gains. As of now, short-term gains are taxed at a flat rate of 15% under the head “Income from Capital Gains.”

– Long-Term Capital Gains (LTCG):

If you hold your equity mutual fund units for more than one year, the gains are considered long-term capital gains. LTCG on equity funds exceeding INR 1 lakh in a financial year are taxed at 10% without indexation benefits.

2. Taxation of Debt Mutual Funds:

– Short-Term Capital Gains (STCG):

If you sell your debt mutual fund units within 3 years of purchase, the gains are considered short-term capital gains and are added to your taxable income, taxed at your applicable slab rates.

– Long-Term Capital Gains (LTCG):

If you hold your debt mutual fund units for more than three years, the gains are considered long-term capital gains. LTCG is taxed at 20% with indexation benefits.

3. Taxation of Hybrid Mutual Funds:

Taxation for hybrid mutual funds is based on the underlying asset allocation (equity or debt) and follows the same guidelines as mentioned above for equity and debt funds.

The fund receives indexation benefits only if the equity allocation lies within the 35% to 60% range.

So, keep a close eye on the fund’s asset allocation to ensure it qualifies for the indexation benefit.

4. Systematic Investment Plans (SIPs):

Each installment of an SIP is treated as a separate investment and follows the taxation rules based on the type and duration of the mutual fund units.

5. Tax-Saving Mutual Funds (ELSS):

Equity-Linked Savings Schemes (ELSS) offer tax benefits under Section 80C of the Income Tax Act. Investments in ELSS funds up to INR 1.5 lakh are eligible for deduction.

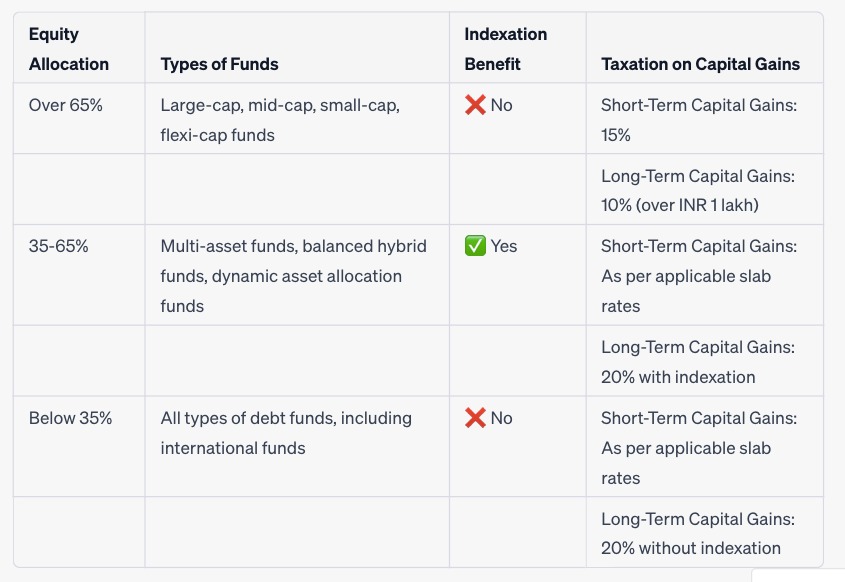

Here’s is the table summarizing the taxation benefits based on equity allocation in different types of mutual fund in india:

This table provides a clear overview of the taxation benefits based on the equity allocation in various types of mutual in india,along with the taxation rates for short term and long term capital gains.

Conclusion

Understanding the tax implications of investing in mutual funds is crucial for maximizing returns and managing your tax liabilities. It’s advisable to consult a tax advisor for personalized advice based on your financial situation. At Invest Pulse Financial Services, we are here to assist you in making informed investment decisions and navigating the world of finance with confidence. Happy investing!

AMFI Registered Mutual Fund Distributor

ARN.250611